Wouldn’t you like becoming a millionaire? Isn’t that everyone’s secret dream, to have a lot of money? You could go on that expensive vacation you’ve always wanted without a pocket pinch or you could purchase all that fancy household stuff. Yes!! To become a Millionaire is quite a goal but!! If you think it is impossible then think again, because with dedication, planning and saving you can actually become one according to financial adviser David Bach whose new book “smart couple finish rich” teaches you to make the impossible possible.

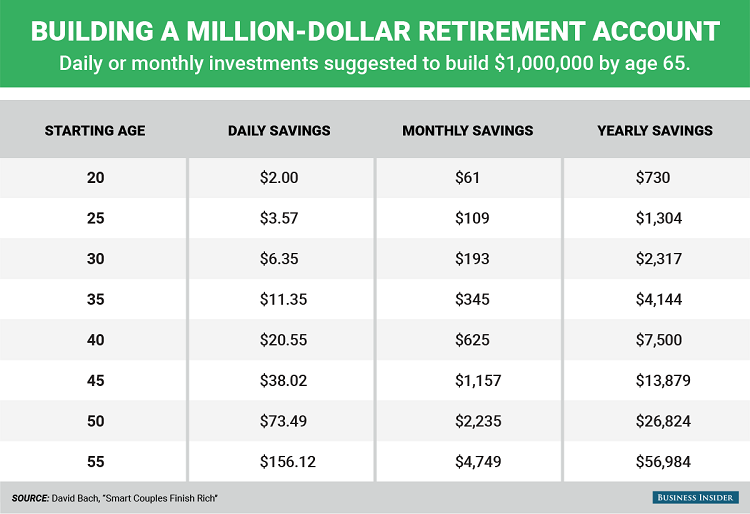

In his new book David Bach shows you how to save to be a millionaire with a little strategic planning where you need to start saving just $2 daily if you are 20 years old or $20.55 if you happen to be forty. Before you hit 65, you are already a millionaire. Sounds good doesn’t it? Well read on.

1 The early bird catches the worm

Advertisement

Bach says that the road to riches is a carefully devised saving and investment plan that you need to start as early as possible. Bach has created a chart to this effect which illustrates how an individual can accumulate wealth by saving over the years. That may be a pretty hard thing to do but it isn’t impossible if you pay attention to the plan.

The chart begins from scratch where it assumes that you don’t have money saved up at all. It also makes an assumption that you have a 12% return annual. This may seem rather unusual given the fact that the standard rate of return is 8 % but Bach wants to show what a few dollars are capable of doing. The chart numbers may not be accurate because of not taking account taxes. But it certainly helps younger people appreciate and value money more. Saving from an early age will benefit you immensely.

Image Source: www.businessinsider.com

2 Start saving now

Advertisement

The Key is to invest and watch your money grow. Just saving your money won’t do, a part of it will have to be invest into time tested funds. In the book “The millionaire next door the secrets of America’s wealthy” it was declared that the average number of America’s wealthy millionaires invested 20% of their income where the majority live beneath their actual means. Another book to read is “Rich Dad Poor Dad: What the Rich Teach their Kids about Money that the Poor and Middle Class do Not!”

This turned out to be the #1 book for advice on personal finance which sold over 27 million copies worldwide. You may earn a large sum of money but that won’t make you wealthy, it’s what you do with your money that counts in the long run. Your money won’t grow just sitting there; ultimately you end up spending more and more of it.

Image Source: www.ytravelblog.com