Some states have consumer credit markets where borrowers have greater needs for getting cash advance loans than others, and Missouri has been one such state where these loans have been around for a while. What's been happening in this state has been a market change from what used to be many brick and mortar stores offering payday loans, to now seeing more consumers gravitate towards installment loans that are offered online and have a few advantages over payday loans. But just who is it that qualifies for these installment loans, and why would they choose to do so instead of getting other traditional personal loans?

1Missouri's Typical Installment Loan Borrower

Advertisement

Borrowers who use installment loans in Missouri actually come from a wide range of income demographics. It's no surprise that generally more females will apply for installment loans than males, and usually borrowers will be under 50 years old. Most will have completed high school, but much less usually have a 4-year college degree. The annual income of most Installment loan borrowers is usually $25,000 or less, although most do claim to work full-time. Usually borrowers are renters, though there do appear to be a significant number of homeowners who also use installment loans. Missouri residents do seem to be quite conscious about how they spend their money and use debt as the state actually has ranked high in having among the least amount of consumer credit card debt nationwide.

Image Source: www.magnifymoney.com

2What Installment Loans Are Usually Used For In Missouri

Advertisement

One reason why online Missouri installment loans are popular are that borrowers are afforded confidentiality in applying for them and don't have to state what they intend to use them for. But what most installment loans are used for are expenses such as covering housing rent when you've had to miss work, auto insurance payments, buying groceries, home or auto repairs, and so much more. Where payday loans could usually cover these expenses for a few hundred dollars and would need to be repaid in just a couple weeks, installment loans allow borrowers to borrow even more funds and they don't have to pay them all back with interest all at once. Instead, money borrowed can be paid back in fixed amounts over several months, and borrowers can pay off their installment loan in full without being hit with an early payment penalty.

Image Source: townnews.com

3Missouri Income and Credit Requirements for Installment Loans

Advertisement

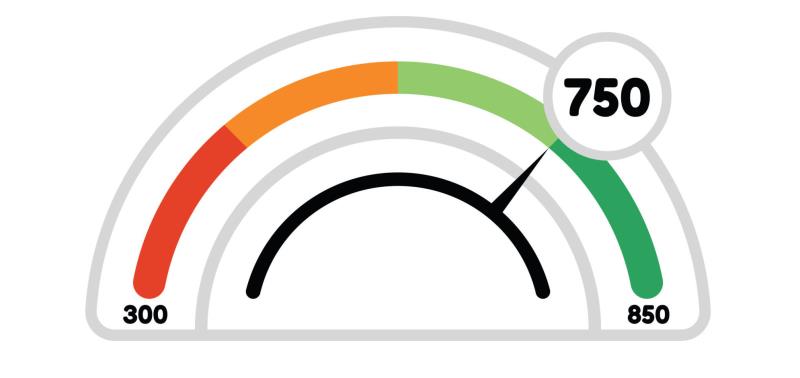

Believe it or not, Missouri actually doesn't require lenders to confirm a borrower's income source. But most lenders will check the borrower's income anyway because they want to know that the borrower is more likely to pay them back than to default. The borrower will also usually need to have a checking account that's been open for some time since the lender will usually collect payments by automatic withdrawals on the due date. There are also no state laws about needing to check a borrower's credit score, but many lenders will conduct what's known as an alternative credit check which is used more to look at a borrower's past payment habits and financial stability rather than just looking at number scores. Most lenders will work with credit that's less than good.

Image Source: netdna-ssl.com